Down in the pits

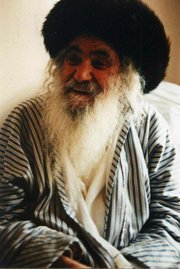

This is a picture of a traditional trading environment. For thousands of years, if you wanted to buy or sell something, you went to the market and haggled on price. At its simplest, this is what the stock markets and exchanges have always been about. Up until about ten years ago, the normal way to trade was to go to a physical place and make deals. The closer you were to the action, the better it was for your trading. This is why people paid hundreds of thousands of dollars to be on the trading floors. Only a fixed number of people can fit into a room and if you wanted to be one of them, you'd better pay up.

Then came along electronic trading and the world changed. No longer did you need to be on the floor standing next to another person to make a deal. You can be doing it all on a computer. You don't all have to stand in the same room. The doors were blown wide open.

Enter the trading world of 2009. The hot trend is "low-latency" trading. A veritable arms race to have the fastest computer trading systems. Whoever gets to the market quickest wins. Remarkably, despite all the high tech hype, one factor which influences how fast your systems can be is how far away physically they are from the stock market's computer. A simple concept really - if you are 10 feet away, the electrons will get there faster than if you are 10 miles away.

So guess what - people are now paying premium dollar to rent space for their computers as close as possible to the exchanges' computers, literally several feet away.

Perhaps without even realizing it, they have just reverted to the same thing we have been doing for millenia - except instead of people screaming in each other's faces we have computers...

1 Comments:

like market orders, stop loss orders are crude instruments. If you intend to hedge your investments there is only one real way to do that: hold opposing positions in the form of securities or contracts on securities. Automated trading triggers are not hedges

Post a Comment

<< Home